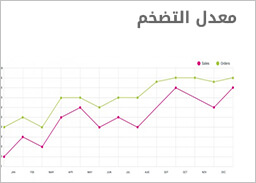

اخبار البنك المركزي

- جديد

- جديد

- جديد

- جديد

- جديد

- جديد

- جديد

- جديد

احدث وظائف البنوك

Prime Relationship Manager

وظائف البنك المصري الخليجي - EG Bank

الخميس 13 ديسمبر 2018

مشاهدة الوظيفة

MINT Customer Relationship Officer

وظائف البنك المصري الخليجي - EG Bank

الخميس 13 ديسمبر 2018

مشاهدة الوظيفة

احدث وظائف الشركات

البنوك المصرية

- البنك المركزي المصري

- البنك الاهلي المصري

- بنك مصر

- بنك القاهرة

- بنك الاسكندرية

- بنك التعمير والإسكان

- المصرف المتحد

- بنك فيصل الاسلامي

- البنك الزراعي المصري

- بنك قناة السويس

- بنك CIB - سي اي بي

- بنك HSBC - اتش اس بي سي

- بنك QNB - قطر الوطني

- البنك العربي الافريقي الدولي - AAIB

- بنك الامارات دبي الوطني - NBD

- البنك الأهلي الكويتي - ABK

- بنك عودة

- البنك الأهلي المتحد

- البنك العربي

- بنك المشرق